(December 2021)

On Tuesday, February 8 the registered voters in Stillwater will have the opportunity to increase the visitor tax (previously known as the hotel tax) for the first time since it was initially approved.

On July 1, 1985, Visit Stillwater was created as a result of a 4% visitor tax that was passed by a vote of the citizens of Stillwater. Approval of the 3% increase will be the only proposed increase in over thirty-six years and will change the visitor tax to 7%. For example, the total tax for a hotel room that costs $100 would increase by only $3 and the total tax for a room that costs $200 would increase by only $6.

The additional revenue will keep local property taxpayers from being burdened with the cost of new visitor development and quality of life amenities - such as athletics facilities - and increase Visit Stillwater marketing, sales, and available grants and sponsorships to recruit new, and expand existing events.

The visitor tax increase will generate approximately an additional $600,000 and the total visitor tax will generate approximately $1.3M in the first year. 30%, or an estimated $400,000, will be invested in visitor development amenities and 70%, or an estimated $920,000, will be invested in a comprehensive marketing and sales plan for the community and over 200 businesses and 2,000 events a year through the Visit Stillwater business plan.

Only persons staying in a hotel, bed and breakfast, or short-term rental within Stillwater will pay the tax. Persons staying in Perry, Enid, and Ponca City to the north are all paying 8% visitor tax. Visitors in Sand Springs to the east of us are paying 7%. Cushing, Guthrie, and Edmond to the south and west are currently 4%. When overflowing visitors go to these communities during Stillwater city-wide events, room rates not tax rates are considered when making lodging decisions.

After the polls close on February 8, 2022, and if the proposition passes, the increase from 4% to 7% will become effective July 1, 2022. Once the revenue is collected, the marketing and sales enhancements and development of the visitor and quality of life amenities will begin.

More visitor tax equates to more sales tax through overnight stays, dining, shopping, tanks of gas, and event attendance. These combined visitor expenditures improve our quality of life through the City of Stillwater essential services and infrastructure.

Visitor development creates jobs, generates business for local hotels, restaurants, attractions, retailers, and service providers, and increases our sales tax revenue through visitor purchases. Also, hotels are among the largest users of city utility services; therefore, an increase in overnight stays will generate more utility revenue for the City of Stillwater to further enhance our quality of life.

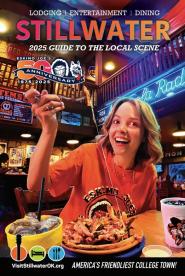

For the most current and up-to-date information regarding the Stillwater hospitality industry, go to VisitStillwater.org, “Like” Visit Stillwater on Facebook, and follow us on Instagram and Twitter at @VisitStillwater. Cristy Morrison, Visit Stillwater President and CEO, can be reached at Cristy@VisitStillwater.org or by calling 405-743-3697.